As UAE businesses accelerate toward digital transformation, the need for robust, compliant, and cloud-based ERP software has never been greater. From VAT compliance to inventory control and the upcoming e-invoicing mandate in 2026, organizations are realizing that an intelligent ERP solution is no longer optional — it’s essential.

Among the many options, Microsoft Dynamics 365 Business Central stands out as the best ERP software in UAE for small, medium, and large enterprises seeking scalability, flexibility, and full compliance with UAE regulations.

Why UAE Businesses Need ERP Software

The UAE’s fast-paced business environment — driven by innovation, regional expansion, and regulatory modernization — requires systems that unify operations, finance, and compliance. Here’s why adopting the right ERP software in UAE is critical:

- Regulatory Readiness: VAT and e-invoicing regulations are tightening. An ERP system ensures real-time compliance.

- Unified Data: ERP connects sales, procurement, inventory, and finance into one intelligent platform.

- Scalability: As your business grows across free zones, emirates, and regions, a centralized ERP scales with you.

- Cloud Accessibility: Cloud-based ERP solutions enable remote work and secure data access from anywhere.

Why Choose Microsoft Dynamics 365 Business Central

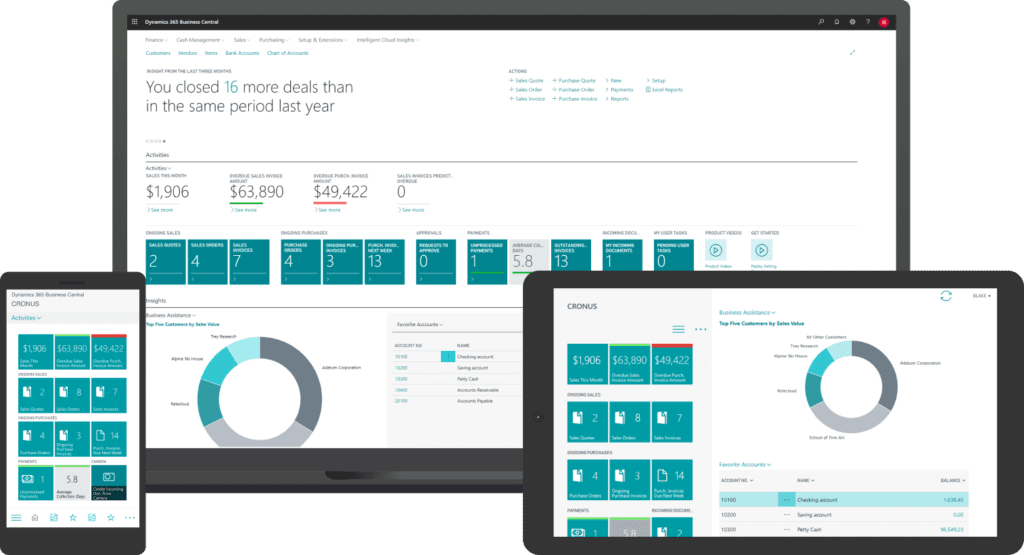

As a trusted Microsoft Partner, Novasoft empowers UAE businesses to implement and customize Microsoft Dynamics 365 Business Central — a powerful, cloud-native ERP solution that integrates seamlessly with your existing Microsoft ecosystem (Excel, Outlook, Teams, Power BI).

🔹 Key Features of Business Central

- Comprehensive Financial Management

Manage general ledger, accounts payable/receivable, budgets, and bank reconciliations with automation and precision. - VAT & E-Invoicing Ready

Fully compliant with UAE VAT law and ready to integrate with the upcoming FTA e-invoicing framework (2026). Generate structured invoices, transmit through accredited channels, and stay audit-ready. - Inventory & Supply Chain Optimization

Gain real-time visibility into stock levels, purchasing, and demand forecasting. Automate replenishment and avoid overstocking or shortages. - Sales & Customer Relationship Management (CRM)

Track opportunities, manage quotes, convert leads, and deliver exceptional customer service within one unified platform. - Project & Job Costing

Plan, execute, and monitor projects with integrated budgeting, resource allocation, and profitability analysis. - Seamless Microsoft 365 Integration

Access, share, and collaborate across Outlook, Excel, and Teams — eliminating data silos and manual entry. - Power BI Analytics & Reporting

Turn raw data into actionable insights using embedded dashboards and AI-driven analytics. - Cloud Security & Scalability

Built on Microsoft Azure, Business Central offers enterprise-grade security, uptime, and flexibility for businesses of all sizes.

The Importance of Upcoming E-Invoicing in UAE (Effective 2026)

The Federal Tax Authority (FTA) has announced a nationwide shift toward mandatory e-invoicing by 2026, aiming to standardize digital transactions, reduce fraud, and improve VAT transparency.

🔸 Key Highlights of the 2026 E-Invoicing Reform

- Mandatory for B2B & B2G transactions – Structured electronic invoices will be required for all business and government dealings.

- Structured XML or PEPPOL format – Invoices must be machine-readable for automatic validation and reporting.

- Accredited Service Providers (ASPs) – Businesses will connect through approved ASPs for secure data transmission to the FTA.

- Legal and archival compliance – Electronic invoices will hold legal validity and must be stored securely for audits.

🔸 How Business Central Helps You Stay Compliant

- Built-in E-Invoicing Integration – Business Central supports global e-invoicing standards (XML/PEPPOL) and can be configured for UAE’s local requirements.

- Automated VAT Reporting – Seamless link between invoicing and VAT modules ensures real-time tax accuracy.

- FTA-Ready Architecture – Easily integrates with accredited ASPs for invoice transmission and validation.

- Audit Trail & Secure Archiving – Every transaction is recorded and securely stored for compliance verification.

By adopting Microsoft Dynamics 365 Business Central now, businesses can transition smoothly into the 2026 e-invoicing framework without costly retrofits.

Benefits of Implementing Business Central ERP Software in UAE

- End-to-End Business Automation – Manage finance, operations, and CRM in one platform.

- UAE-Specific Compliance – Stay VAT and e-invoicing ready.

- Reduced Manual Errors – Automated processes improve accuracy and efficiency.

- Informed Decisions – Real-time analytics empower leaders to act quickly.

- Scalable Cloud Model – Grow without worrying about infrastructure limits.

Implementation Best Practices

- Partner with Certified Experts – Work with Novasoft’s Microsoft-certified consultants for tailored setup.

- Data Preparation – Clean up master data (TRNs, vendors, items) before migration.

- Phased Rollout – Implement finance first, then add inventory, sales, and e-invoicing modules.

- Employee Training – Ensure teams are ready to use and maintain the system effectively.

- Ongoing Optimization – Monitor KPIs and refine workflows post-implementation.

Final Thoughts

With e-invoicing becoming mandatory by 2026, the time to modernize your business systems is now. Microsoft Dynamics 365 Business Central offers everything UAE businesses need — from VAT compliance and e-invoicing readiness to AI-powered insights and cloud scalability.

As a Microsoft Partner, Novasoft helps companies across the UAE deploy, customize, and optimize Business Central to ensure full compliance, operational efficiency, and future-readiness.

Contact us at contact@novasoft.global for a free consultation and product demo.